Accrued revenues and expenses are necessary parts of monetary statements. Accrued revenues are recorded as a current asset, whereas accrued expenses are recorded as a present legal responsibility. Accruals are a elementary idea in accounting that refers back to the recognition of revenues and expenses within the period in which they’re incurred, regardless of when payment is obtained or made. They are a key part of the accrual accounting methodology, which is used by most businesses to prepare their monetary statements. Accruals refer to revenues earned or expenses incurred by an organization that have not yet been paid or acquired.

Operating expenses are the costs needed for a company to take care of its main business activities. For example, the rent a business pays for its retail house or manufacturing services is an working expense. It is recorded on the earnings statement and displays the cost of using the property for the period covered by the income assertion. In this manner, the balance sheet reveals how the resources managed by the business (assets) are financed by debt (liabilities) or shareholder investments (equity). Investors and creditors generally take a glance at the assertion of economic position for insight as to how effectively an organization can use its assets and how effectively it might possibly finance them. The accounting equation enables you to see the value in your small business once you account for all of your belongings and liabilities.

Utility expense is a direct line merchandise on the earnings assertion, typically categorized as an operating expense. In conclusion, incorporating bills on the steadiness sheet provides a more holistic view of a company’s monetary panorama. General, together with bills on the stability sheet provides a more full financial image and enhances the transparency and accuracy of the company’s financial statements.

- Nevertheless, associated accounts such as ‘rent payable’ and ‘deferred rent’ are liability accounts that appear on the stability sheet.

- The nature of lease expense can range significantly between various kinds of firms.

- Shaun Conrad is a Certified Public Accountant and CPA examination expert with a passion for teaching.

- Understanding the distinction between the balance sheet vs income statement is essential to mastering your monetary statements.

- This implies that income is recorded when it’s earned, and expenses are recorded when they’re incurred.

- At the end of an accounting period, the web earnings or loss, after accounting for all revenues and expenses, is transferred to retained earnings within the equity section of the balance sheet.

For instance, you might accrue an expense for a potential payout for a lawsuit that will not be settled for more than a year. Assume of them because the VIPs at the monetary party—showcasing what your company owns, what it owes, and what’s left over for you (that’s equity) after settling all of the tabs. In brief, expenses appear directly in the revenue assertion and indirectly in the balance sheet. It is helpful to always learn both the revenue assertion and the steadiness sheet of a company, so that the full effect of an expense can be seen. If a dividend is within the form of more company stock, it could end result in the shifting of funds within equity accounts within the balance sheet, nevertheless it is not going to change the overall equity stability. Now that the steadiness sheet is ready and the beginning and ending money balances are calculated, the assertion of cash flows can be ready.

It is essential to notice that the particular varieties and categories of bills can range based on the business, measurement of the company, and accounting standards followed. Retained earnings, a key a half of the equity part, is the cumulative internet earnings minus any dividends paid to shareholders. This line merchandise modifications based on the net income or loss, which is instantly influenced by the company’s bills. A dividend is a distribution made to shareholders that’s proportional to the number of shares owned. It is paid out from the retained earnings of a enterprise, and may be paid to the holders of common stock or preferred stock. A dividend isn’t an expense to the paying firm, however rather a distribution of its retained earnings.

Accurate accounting is necessary for managing accrued interest successfully. Adjusting entries and bond issues at par reflect the true financial position of an organization. Having a strong understanding of the accrual technique is crucial for each borrowers and lenders. Common accruals for small businesses and sole proprietorships include gross receipts, finances, and accounts payable. Gross receipts are the total amount of cash acquired by the enterprise from gross sales or providers rendered. Funds check with any loans or strains of credit that the business has taken out.

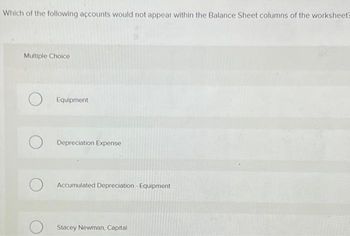

How Expenses Move Through Financial Statements

If expenses are paid in cash, they also lower the cash asset on the stability sheet. If they are accrued but not paid, they enhance the liabilities within the form of accounts payable. In financial reporting, lease expense should be disclosed according to accounting requirements. This ensures that the monetary statements precisely replicate the company’s financial place and performance. A steadiness sheet offers a snapshot of a company’s property, liabilities, and shareholders’ fairness at a specific time limit. Expenses, nevertheless, are recorded in the earnings assertion, which details the company’s revenues and bills over a period to calculate web revenue.

How Are Accruals Recorded On A Stability Sheet?

The steadiness sheet is probably considered one of the three primary monetary statements used to judge a company’s financial position. Understanding liabilities and bills, their variations, and their impression on monetary statements is fundamental to efficient enterprise accounting. Correct classification not only provides readability but additionally helps accurate monetary reporting and compliance. Expenses are recorded on the revenue statement, instantly affecting web revenue and, subsequently, retained earnings on the steadiness sheet. Misclassifying bills or liabilities can distort a company’s financial https://www.simple-accounting.org/ health, affecting investor confidence and decision-making.

Accrual Accounting’s Function In Financial Reporting

Accrued interest is normally counted as a present asset, for a lender, or a current liability, for a borrower, since it’s anticipated to be received or paid inside one yr. Then, as you document transactions (such as loan payments or depreciation), the software program updates your steadiness sheet within the background automatically. To show you ways assets, liabilities, and equity work collectively, let’s track how taking out a loan, buying gear, making a loan fee, and claiming depreciation affect a steadiness sheet. It can be the idea of the cash foundation of accounting, which is a simplified model of cash accounting that is used by some companies. This means that a company has acquired companies or items from a provider, but the fee for those services or goods has not been made yet. This signifies that a company has supplied providers or delivered items to a customer, but the cost for those services or goods has not been obtained yet.

My Accounting Course is a world-class academic resource developed by specialists to simplify accounting, finance, & investment analysis matters, so students and professionals can be taught and propel their careers. Shaun Conrad is a Licensed Public Accountant and CPA exam skilled with a passion for instructing. After virtually a decade of expertise in public accounting, he created MyAccountingCourse.com to help individuals study accounting & finance, move the CPA exam, and begin their career. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, advisor, college instructor, and innovator in teaching accounting online. For the previous fifty two years, Harold Averkamp (CPA, MBA) has labored as an accounting supervisor, supervisor, marketing consultant, college teacher, and innovator in teaching accounting on-line.